Looking into Perplexity AI stock? With the company’s private status, purchasing this stock is not straightforward, attracting a discerning investor audience. In this article, we’ll scrutinize Perplexity AI’s financials and market niche, providing clarity on its investment complexities. Read on for concise insights into whether Perplexity AI merits investor attention within the AI industry’s rapidly evolving landscape.

Key Takeaways

Perplexity AI has achieved significant user growth in the AI search platform market, competing with industry giants by offering diverse, open-source, and GPT-4 integrated search experiences to various user segments.

Despite currently being unprofitable, Perplexity AI has secured impressive funding, raising its valuation to over $1 billion, it leverages a freemium model, and boasts partnerships that could lead to accelerated revenue growth.

Investing in private company Perplexity AI involves navigating secondary markets and adhering to accredited investor criteria, offering unique opportunities for high-resource individuals and institutions to participate in its growth.

Exploring Perplexity AI’s Market Position

The ascent of Perplexity AI in the world of search engines is nothing short of meteoric. With user visits skyrocketing from a humble 2.2 million to an astounding 45 million within a year, and processing over half a billion requests, Perplexity AI has etched its name onto the AI search platform landscape. This surge in user engagement is a testament to the company’s commitment to revolutionizing search and SEO experiences, despite facing the Goliath that is Google’s 90% market dominance.

Perplexity AI’s allure doesn’t end there; it caters to a diverse user base, from researchers to artists, offering an open-source core search experience augmented by GPT-4 integration at no cost. This strategic positioning allows perplexity to carve a niche, beckoning perplexity investors to consider the potential of buy perplexity stock.

As we peel back the layers of Perplexity AI’s market presence, it becomes clear that the company’s rapid user growth and niche focus in the AI-driven search engine domain have placed it on the radar of many. But what of its financial underpinnings? Is the foundation as robust as the surface suggests?

Understanding Perplexity AI’s Financial Health

Navigating the fiscal landscape of Perplexity AI reveals a picture of a company in its growth phase. While the company is unprofitable, generating around $20 million in annual revenue, it has still managed to secure a remarkable $165 million in funding. This financial backing has catapulted the company’s valuation to over a staggering $1 billion, signaling to perplexity investors a beacon of growth potential despite the absence of profits.

| Year | Revenue (in millions) |

|---|---|

| 2022 | $5 – $10 |

| 2023 | $10 |

| 2024 | $15 – $20 |

The real question is: where does this funding come from, and how is Perplexity AI generating its current revenue?

Revenue Streams

Perplexity AI’s revenue strategy is emblematic of the freemium business model that has disrupted numerous industries. At its core, the company’s search platform is free, leveraging the power of OpenAI’s GPT-3.5. However, for those seeking more refined capabilities, Perplexity Pro emerges as the paid version, offering advanced functionalities that cater to the needs of power users by integrating higher-tier models like GPT-4 and other specialized AI systems. April 2024 marked a strategic expansion for the company with the roll-out of an enterprise version designed to entice business clients. This move, combined with partnerships with telecom giants SoftBank Corp. and Deutsche Telekom, significantly broadens the potential user base to over 335 million. These revenue streams, while still in their infancy, indicate a trajectory that could propel the company towards market share gains and funding rounds that bolster its investment appeal.

Yet, the true measure of a company’s financial prowess is often reflected in its funding success. Perplexity AI’s journey through venture capital landscapes paints a picture of a company that has captured the imagination and confidence of its investors.

Funding Success

The funding rounds of Perplexity AI have been a showcase of investor confidence, with recent injections of capital doubling the company’s valuation to a behemoth figure north of $1 billion. The cast of investors, a veritable who’s who of the business and tech worlds, includes the likes of:

Daniel Gross

Stanley Druckenmiller

Garry Tan

Nvidia

Elad Gil

Nat Friedman

Jeff Bezos

All of whom have lent their support and financial clout to the company’s vision. With a diverse investor base of 54 stakeholders, Perplexity AI has not only secured their trust but also their resources, which are crucial for advancing the company’s ambitious projects. It’s the kind of backing that speaks volumes of the company’s potential and beckons potential investors to develop skills and strategies to take part in this journey.

But the story of funding doesn’t end here; the valuation trajectory of Perplexity AI points towards a future that could be even more lucrative for those who have invested in its promise.

| Year | Funding Round | Amount Raised | Valuation |

|---|---|---|---|

| 2022 | Seed | Undisclosed | – |

| 2023 | Series A | $25.6 million | – |

| 2024 | Series B | $73.6 million | $520 million |

| 2024 | Series C | $62.7 million | Over $1 billion |

| 2024 | Current Round | $250M+ (ongoing) | $2.5B – $3B (potential) |

Valuation Over Time

Perplexity AI’s valuation tale is one of incremental triumphs. The company’s financial growth is evidenced by significant valuation increases over time, with the most recent funding round in April 2024 valuing the company at over $1 billion. Whispers of a new funding round of at least $250 million aim to propel the company’s valuation even further, to a towering $2.5 to $3 billion. Such meteoric rises in valuation not only underscore the company’s growth but also offer tantalizing exit opportunities for current investors, bolstered by successful funding milestones and ongoing financial growth.

However, to capitalize on such opportunities, one must first understand the mechanics of buying Perplexity stock, a journey not without its own set of complexities and considerations.

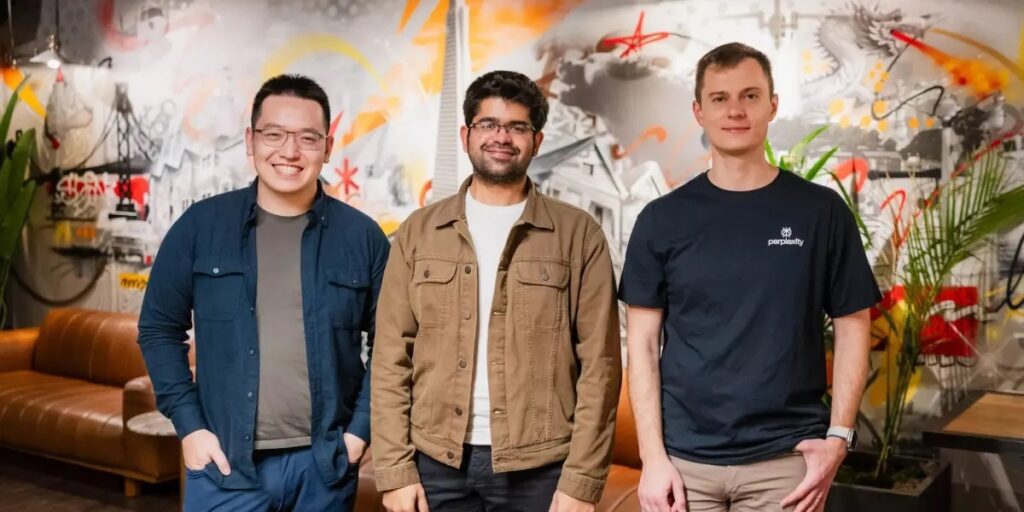

The Leadership Impacting Perplexity’s Growth

The symphony of Perplexity AI’s progress, based in San Francisco CA, is conducted by a leadership team whose expertise spans the realms of AI research and strategic business development. With Chief Technology Officer Denis Yarats bringing a wealth of AI knowledge from Meta and Chief Strategy Officer Johnny Ho merging his engineering prowess from Quora with the analytical rigor of Wall Street, the executive team is primed to lead the company towards innovative frontiers. These leaders, alongside others, are instrumental in nurturing Perplexity AI’s environment of growth and innovation.

However, it is not just the executive team that influences the company’s trajectory, as the impact of the board members, although less publicly disclosed, cannot be understated.

Executive Team

The executive team of Perplexity AI is a mosaic of talents with Aravind Srinivas at the helm as CEO, bringing a revered background in AI and machine learning from prestigious institutions like Deepmind, Google, and OpenAI. This diversity of experience, which spans the consumer and enterprise sectors, equips the leadership with a panoramic view of the AI landscape.

Andy Konwinski, the company’s President and co-founder, complements this picture with his track record of scaling high-growth tech companies, as evidenced by his tenure at Databricks. The amalgamation of business acumen and AI sophistication within the executive team provides a fertile ground for Perplexity AI’s continuous expansion and innovation. It’s a leadership dynamic that melds deep technical knowledge with strategic business instincts, a combination that is crucial for the company’s success in the fast-evolving AI industry.

Board Influence

The influence of Perplexity AI’s board on the company’s strategic direction is shrouded in privacy, with specific details remaining undisclosed for illustrative purposes. Nonetheless, the presence of seasoned board members undoubtedly plays a role in guiding the company’s long-term vision and ensuring that its trajectory aligns with the interests of perplexity investors.

With the executive team and board members steering the ship, Perplexity AI navigates through the competitive waters of the AI industry. But how does it compare to other investment opportunities in the AI landscape?

Comparing Investment Opportunities in AI

In the burgeoning field of AI, Perplexity AI stands as a beacon of potential, buoyed by its disruptive capabilities and the backing of elite investors. While direct investment in Perplexity AI stock may be out of reach for the general public, there are alternative routes to tap into the AI market. Investing in companies like Nvidia offers indirect exposure, courtesy of Nvidia’s stake in Perplexity AI.

Additionally, behemoths like Microsoft and Alphabet, with their investments in OpenAI and leadership in generative AI, respectively, represent formidable investment opportunities in the AI sector. These companies, along with others pioneering AI innovations, provide investors with a diverse array of options to engage with the AI market. Within this landscape, Perplexity AI’s niche position as an AI search platform adds a unique flavor to the investment mix.

AI Search Platforms

Perplexity AI’s role in the generative AI market epitomizes the transformative power of AI search platforms. These platforms are revolutionizing the way we interact with search engines, shifting the status quo towards a future where search engine optimization is heavily influenced by AI. Marketers are now tasked with adapting their strategies to accommodate algorithms that prioritize a variety of content types and user intents. This evolution in search not only enhances the user experience by delivering more personalized results but also opens up opportunities for marketers to connect with their audiences more effectively. The advent of AI-driven search engines like Perplexity AI challenges the dominance of traditional search engines, setting the stage for a dynamic shift in the competitive landscape of search technology.

The potency of AI search platforms extends beyond user experience to redefine the very nature of search itself. As these platforms grow in sophistication, they are poised to become indispensable tools for users and marketers alike. This disruption in the search engine market underscores the strategic potential of investing in AI-driven platforms that are reshaping the industry. However, the picture is incomplete without considering the hardware innovations that underpin these advancements.

AI Hardware Innovations

The backbone of AI’s capabilities lies in the hardware that powers it, and Taiwan Semiconductor Manufacturing Company (TSMC) is at the forefront of this technological revolution. As the primary producer of advanced AI semiconductors, TSMC’s role in enabling AI applications is pivotal. These semiconductors are the lifeblood of AI systems, fueling everything from the search platforms of Perplexity AI in San Francisco to the vast neural networks of large language models.

As AI becomes increasingly embedded in our world, the demand for cutting-edge hardware continues to surge. This underscores the importance of considering hardware manufacturers like TSMC as integral parts of the investment conversation in AI. The interplay between software innovations and hardware advancements is a critical aspect of the AI ecosystem, one that Perplexity AI is well-positioned to capitalize on.

Perplexity AI’s Vision for Artificial Intelligence

Perplexity AI’s vision for artificial intelligence is one that breaks away from tradition, offering instant answers and a conversational AI interface that stands in stark contrast to the keyword-based queries of the past. This conversational approach to AI is not only intuitive but also aims to provide users with comprehensive responses to complex questions, complete with relevant sources and citations. The company’s partnership with SoundHound AI extends its conversational AI capabilities across various devices, enabling real-time, conversational responses to web-based queries. Perplexity AI’s search interface is powered by models like OpenAI’s GPT 3.5 and Microsoft Bing, which summarize answers with verification citations, reflecting the company’s commitment to accuracy and relevance.

Perplexity AI’s ambitious vision doesn’t stop at redefining search; it extends to becoming a multifaceted tool that caters to:

academic research

journalism

content marketing

business research

The platform’s focus on the development of beneficial artificial general intelligence is a clear indication of its future-focused mindset. By positioning itself as more than just a search engine, Perplexity AI delivers versatile tools suited to a variety of content needs, supporting its broader vision for the role of artificial intelligence in our lives.

The company’s forward-thinking approach to AI sets it apart from the competition and underscores its potential for impact across multiple domains. Now, as we draw the threads of this narrative together, let us reflect on the key takeaways from our exploration of Perplexity AI.

Summary

Our journey through the world of Perplexity AI has revealed a company at the forefront of the AI-driven search engine revolution, marked by rapid user growth and an innovative market position. Despite its current lack of profitability, the company’s impressive funding achievements and soaring valuation speak volumes about its growth potential. The mechanics of buying and selling Perplexity stock, though complex, offer accredited investors a unique opportunity to participate in the company’s ascent. The executive leadership and board of Perplexity AI, with their amalgamation of technical prowess and strategic insight, are pivotal in steering the company towards innovation and market expansion.

Perplexity AI’s integration into the broader tech ecosystem through strategic investments and partnerships, as well as its ambitious vision for artificial intelligence, positions it as a beacon of promise in the AI space. As the industry evolves, Perplexity AI remains a significant player, offering investors the chance to be part of a company that is not only shaping the future of search but also contributing to the development of beneficial AI. This exploration serves as a guide for those looking to navigate the future of investment in AI, providing insights into the potential of Perplexity AI as a smart investment choice.

Frequently Asked Questions

What is the current market position of Perplexity AI?

Perplexity AI has achieved significant user growth, reaching 10 million monthly active users, and has established a strong position in the AI-driven search engine sector, with a focus on enhancing search and SEO experiences.

How financially healthy is Perplexity AI?

Perplexity AI has strong growth potential despite being currently unprofitable, as it has secured $165 million in funding and a valuation exceeding $1 billion.

Can the general public purchase stock in Perplexity AI?

Unfortunately, the general public cannot purchase stock in Perplexity AI as it has not gone public and is not traded on the stock market. Only accredited investors can access shares through secondary market platforms like Forge and EquityZen.

Who are some of the key leaders at Perplexity AI?

Some of the key leaders at Perplexity AI include CEO Aravind Srinivas, CTO Denis Yarats, and CSO Johnny Ho. They bring expertise in AI, research, engineering, and analytics to the company.

What is Perplexity AI’s vision for the future of artificial intelligence?

Perplexity AI’s vision for the future of artificial intelligence is to create conversational AI that provides instant answers with relevant citations and serves as a versatile tool for various content needs, contributing to the development of beneficial artificial general intelligence.